Illinois has certainly shown itself to be fertile territory for gambling.

The Land of Lincoln has bricks-and-mortar casinos, retail and mobile sports betting, horse racing, the traditional lottery, and digital gaming devices — what most folks would call slots — in thousands of non-casino locations throughout the state.

In 2021, the state’s 11 casinos accounted for $1.71 billion in revenue, and Illinois sportsbooks had total revenue of $524.8 million making it the second largest U.S. sports betting market last year behind only New Jersey, according to the American Gaming Association’s annual report.

Meanwhile, some in the Illinois legislature are advancing the idea of iCasino — meaning casino games, such as slots and table games, available on computers and mobile devices — for the commonwealth.

In 2021, State Sen. Cristina Castro introduced the Internet Gaming Act that would have legalized iCasino, also known as iGaming, with a 15% tax rate. The Illinois two-year 2021-22 session ended in April without further meaningful action on the bill but it, or something similar, could be revived in the future although a considerable amount of attention and energy will be taken up by the building of a Las Vegas-style casino in Chicago.

The Illinois sports betting market is continuously evolving. In November 2023, ESPN BET sportsbook was launched. In 2024, Illinois will welcome the Fanatics sportsbook to the scene.

Tax Revenue from iCasino Even Greater

Perhaps looking to give a lift to such efforts such as the Illinois Internet Gaming Act, a recent report issued by gaming company Light and Wonder and prepared by gaming research organization VIXIO GamblingCompliance highlighted the tax revenues that states could realize by launching iCasino play. For now, only New Jersey, Pennsylvania, Michigan, Delaware, West Virginia and Connecticut have iCasino (Nevada allows only online poker).

The report projects that Illinois online casinos would potentially produce an additional $1.368 billion a year in gross gaming revenue and an additional $273.7 billion annually in potential tax revenue, assuming a 20% tax rate.

Illinois Has Issues to Consider

However, there are plenty of issues to be considered before those figures are swallowed whole.

For starters, even Sen. Castro’s proposed iCasino legislation that withered carried just a 15% tax rate.

Secondly, the state’s Commission on Government Forecasting and Accountability, responding to direction from the legislature, added further context to the iCasino discussion in Illinois.

In a report issued in July 2021, which was crystal-balling the impact of iCasino on tax receipts if that type of gambling had been in place during 16 months of the COVID-19 pandemic, there was discussion of the impacts associated with the fact that there are over 7,500 non-casino locations that offer more than 40,000 video gaming terminals across the state.

This substantial amount of so-called “convenience gambling,” at least in gross numbers, doesn’t exist anywhere else in America with the arguable exception of Nevada, which tops Illinois for non-casino slots on a per-capita basis. Those tens of thousands of slots offer competitive headwinds for iCasino that don’t exist hardly anywhere else. Plus, any calculation on overall tax revenue gain has to account for iCasino cannibalizing those non-casino slots that are in neighborhood locations.

The Illinois agency’s report offered several scenarios in projecting tax revenues for the pandemic’s 16 months and the results represented a huge spread from $75 million to $230 million, but an important caveat is that the financial projections for online play were in conditions that were ideal for stay-at-home gambling.

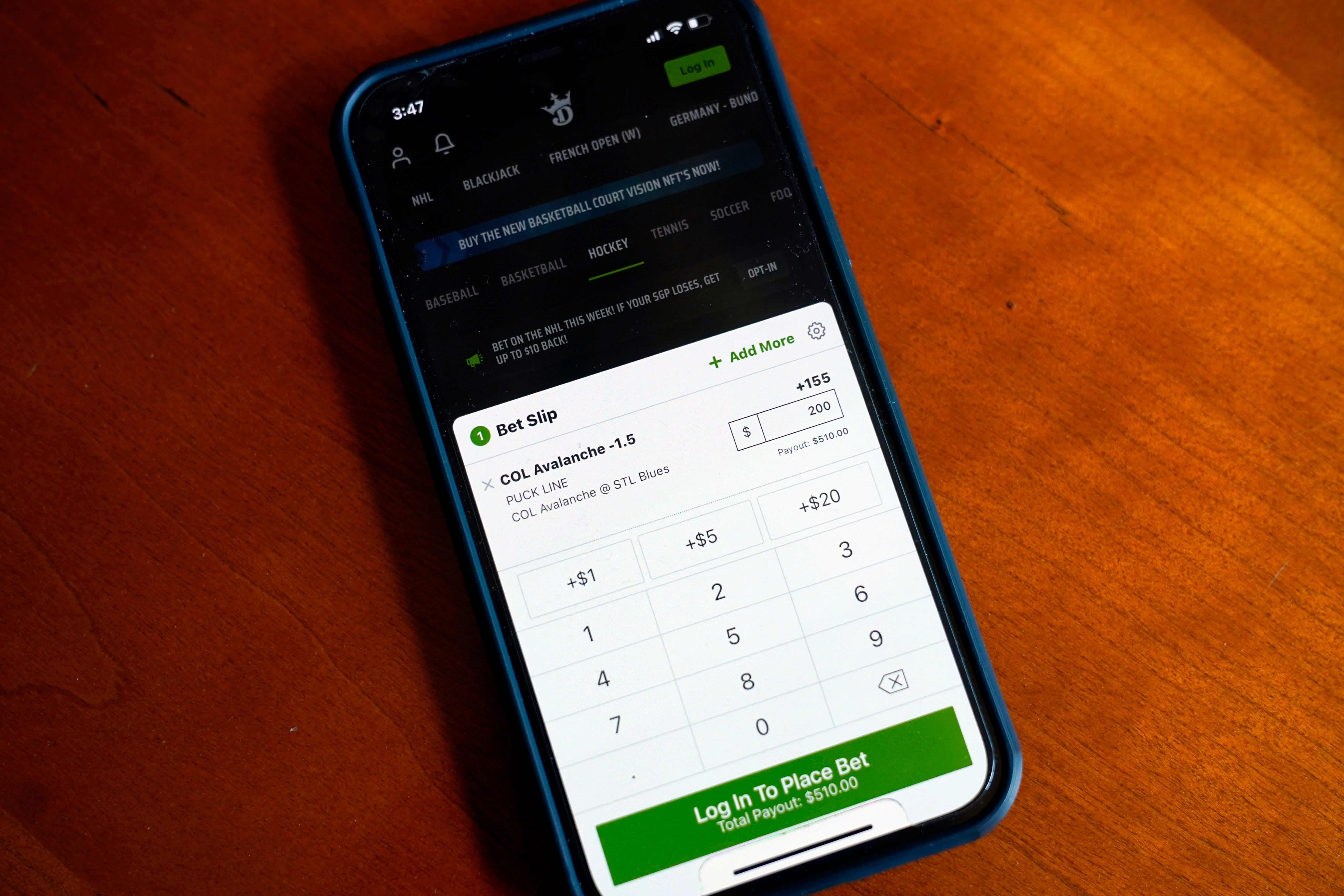

Claim Today: Illinois Sportsbook Promos like the one you see below

Illinois Could Look at Michigan’s Success

Revenue and tax projections based on hypotheticals aside, the reality is that Illinois already has the example of one nearby state where iCasino is going full-throttle and doing quite well, Michigan. And two other Midwest states, Indiana and Iowa, have also been considering iCasino. All three nearby states have legal online sports betting, too, but they haven't had near the success as Illinois betting apps.

Historically in gambling expansion, the domino effect has been a powerful influencer, especially if a state legislature thinks it is leaving money on the table from a tax scheme that’s less direct than income taxes or sales taxes.