Illinois Gov. J.B. Pritzker wants to more than double the state’s sports betting tax, a move that would make it one of the steepest in the country on operator revenues.

The governor included the proposal for a 35% tax rate for Illinois sportsbooks in his budget proposal, which he unveiled to lawmakers Wednesday.

“This change would bring Illinois’ tax rate closer to peer states’ tax structures,” the budget document states.

🔥 Note: Visit our Illinois Gambling Tax Calculator to calculate what you owe in taxes from your gambling winnings.

If approved, the governor’s office anticipates the state receiving more than $200 million in additional taxes from sports betting operators than it will in this fiscal year. The budget currently estimates Illinois will receive $151 million from the 15% tax during this fiscal year, which ends June 30.

Under the proposal, roughly 43% of the tax (or 15 percentage points) would go toward paying down state debt. The remainder would go into the general fund coffers.

On Tuesday, the Chicago Tribune reported the state faced a $900 million spending gap heading into the next fiscal year.

At 15%, Illinois is roughly in the middle of the pack in terms of taxes among states that have legalized sports betting. The 35% rate would be lower than only Pennsylvania’s 36% and the 51% rate charged in New York, Rhode Island and New Hampshire.

Rhode Island and New Hampshire are single-operator states; the others in that list license multiple operators.

Illinois a Sports Betting Giant

The discussion of raising the tax comes just after a report from the American Gaming Association found that Illinois sports betting operators earned slightly more than $1 billion in revenue, up more than 26% from 2022. That was good for third nationally and roughly $4.3 million less than sportsbooks in New Jersey won. New York led the nation, with operators winning nearly $1.7 billion.

Illinois would not be the first state to adjust its tax after passing sports betting legislation. Last year, Ohio lawmakers, just six months into legal betting starting there, doubled that state’s rate to 20%.

In its first year of sports betting, Ohio operators earned more than $936 million in revenue, the fourth-highest total nationally.

Tennessee lawmakers also revised their state’s tax last year, going from a 20% levy on online operator revenues to a 1.85% rate on operator monthly handles, or the amount of money wagered.

Is Illinois an iGaming ‘Darkhorse’?

With the Land of Lincoln needing to raise revenue to meet its budgetary needs, some in the gaming industry have predicted the state would be one of the next to legalize iGaming, or Illinois online casinos.

State Sen. Cristina Castro, D-Elgin, filed Senate Bill 1656 last year. It did not receive a committee hearing in 2023, but the bill is still alive for this year’s session. Earlier this month, it was assigned to the Senate’s Subcommittee on Gaming, Wagering and Racing, where Castro serves as its vice chair.

SB 1656, called the Internet Gaming Act, would allow licensed operators to partner with up to three skins. It also would tax operators at 15%.

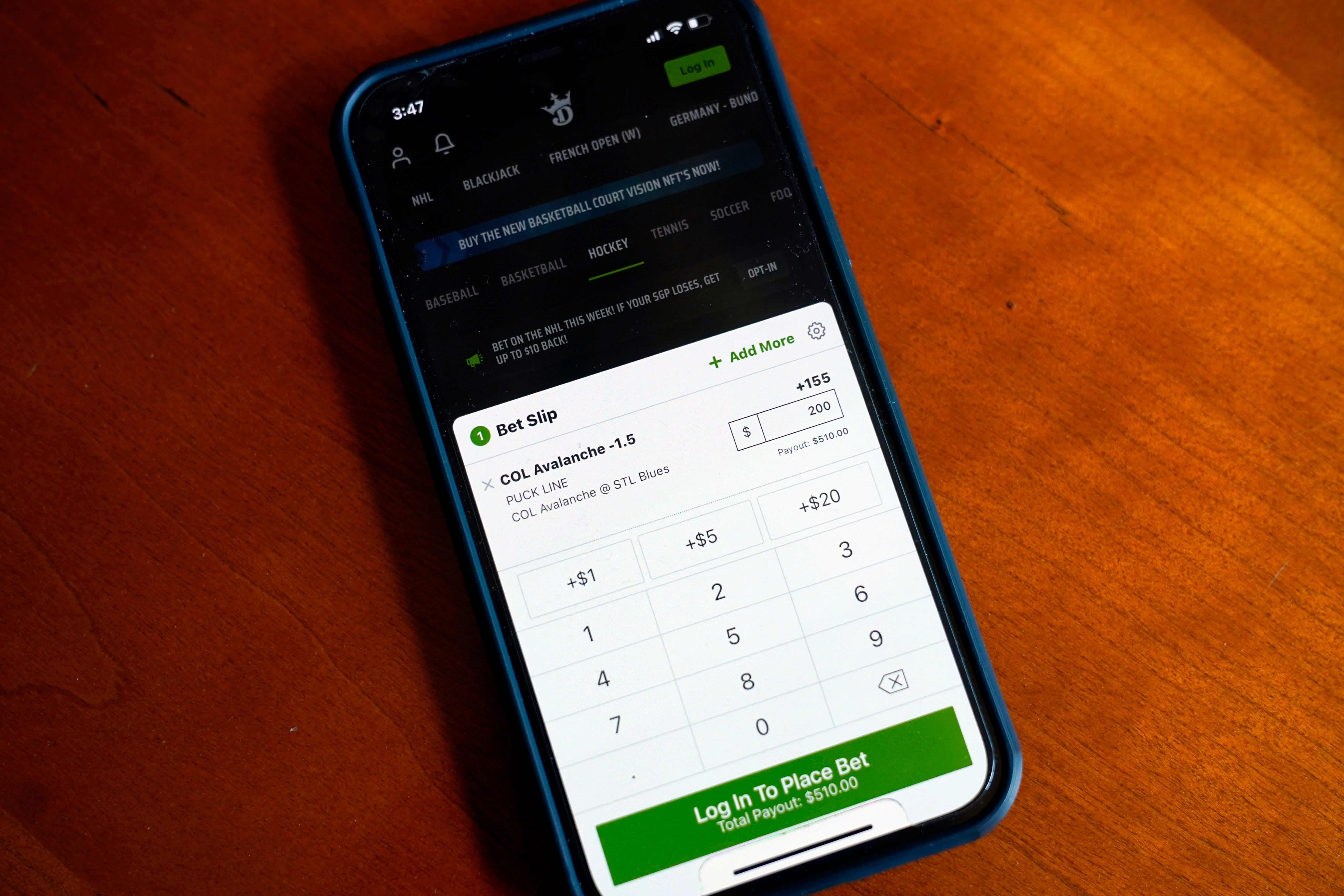

Even with the bill, Illinois has not been considered a state that likely would pass iGaming legislation this year. However, during a call with investment analysts last Friday to discuss the company’s fourth-quarter performance, Jason Robins, DraftKings co-founder, CEO and chairman, called the state “a dark horse” for passage this year.

“We talked a few years ago about post-COVID and how that was going to be a real catalyst, given states would need tax revenue,” Robins said on the call. “What we ended up seeing was that so much federal money was pumped into the state’s coffers that that… kind of extended that timeline a bit. But now that’s coming to an end in many states. They’re starting to see budgets that really look a lot like the budgets four or five years ago in many states, and the surpluses in some of these states are no longer there.”

Count on IllinoisBet.com to keep a close watch on the tax issue and iGaming, as well as provide top Illinois sportsbook promos.