Beginning July 1, 2025, Illinois introduced a per-wager tax on online sports bets, charging licensed sportsbooks based on the total number of bets placed each year.

The structure sets a $0.25 fee per wager for the first 20 million bets and a $0.50 fee for each bet above that threshold. The new levy led to a short-term dip in overall wagering activity, though state revenue from Illinois sports betting rose.

This per-wager tax is applied on top of Illinois’ progressive tax on adjusted gross gaming revenue (AGR), which ranges from 20% to 40% depending on an operator’s annual earnings.

How Did the Tax Change Impact Bettors?

The tax change has also led to operational adjustments across the market, with many sports betting apps passing costs on to consumers through added fees or higher minimum bets. BetMGM raised its minimum wager to $2.50, Hard Rock to $2.00, theScore remains at $1.00, Circa Sports increased its minimum to $10.00, and BetRivers raised its minimum wager from $1.00 to $5.00.

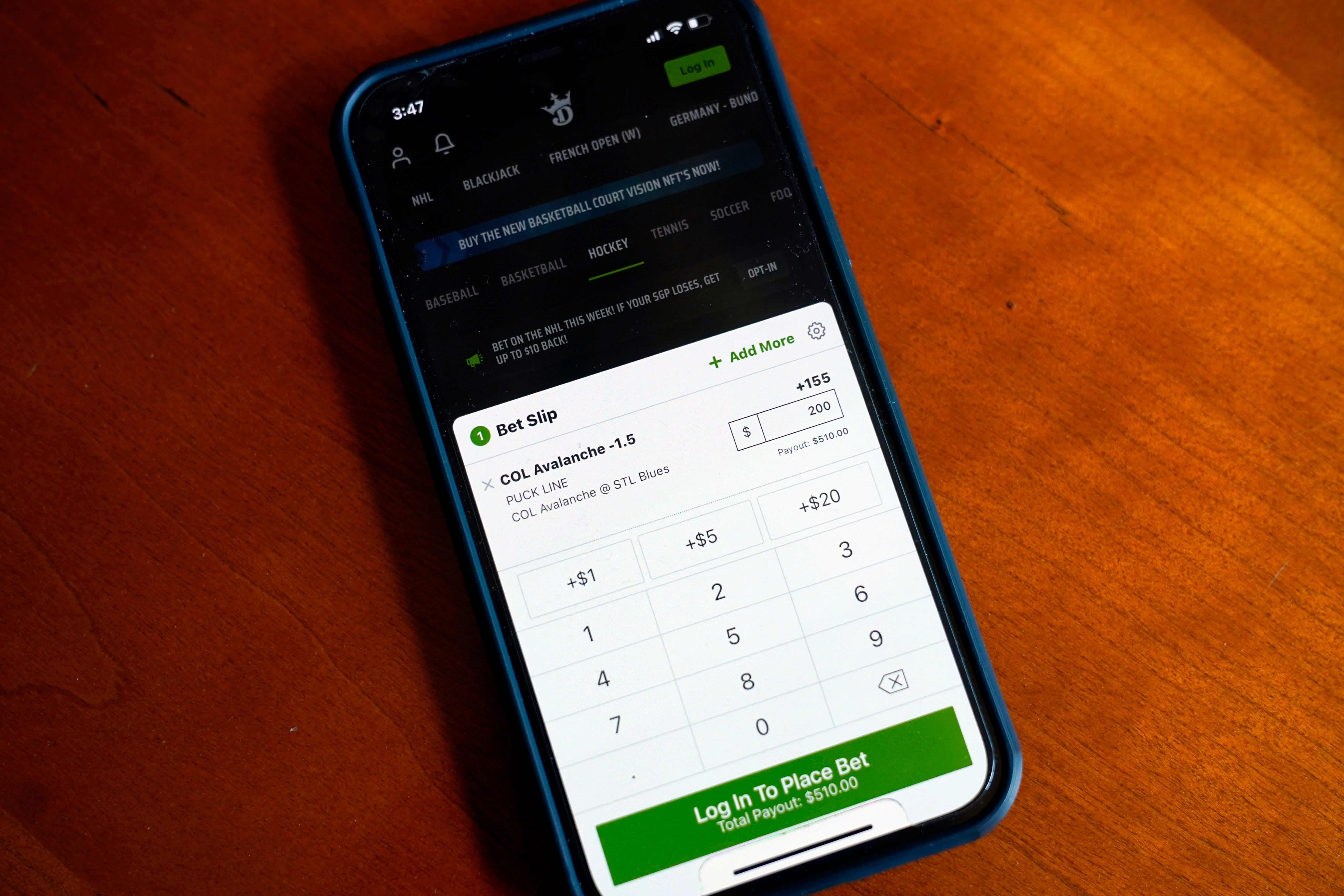

Direct surcharges were implemented as well: DraftKings Illinois and FanDuel charge $0.50 per wager, Fanatics and Caesars Illinois $0.25, and bet365 applies $0.25 specifically on bets under $10.

More Changes Coming in 2026

Additional changes are set to take effect in 2026. Starting January 1, Illinois bettors will be able to deduct only 90% of their gambling losses on state taxes, while all winnings remain fully taxable as income. At the same time, Chicago implemented a 10.25% city-level tax on sports betting revenue, which could push the effective tax rate for some operators above 50%, further influencing pricing and betting strategies across the market.