It was a Super Bowl Sunday to remember for sports betting in Illinois, with north of $60 million in wagers collected during the Big Game.

The Illinois Gaming Board’s Super Bowl breakdown showed more than $54.7 million in online handle during Super Bowl LVI, in addition to $5.7 million in retail wagers.

The state collected $1.4 million in tax revenue during Sunday’s Big Game off $9.5 million in aggregate gross revenue, marking the biggest haul for the Super Bowl since Illinois launched sports betting in 2020.

Illinois raked in $45.6 million in sports betting wagers during Super Bowl LV in 2021, with $7.7 million in AGR and $1.1 million in tax revenue.

Illinois' 2022 Super Bowl handle trailed sports betting stalwarts like Nevada ($179.8 million) and New Jersey ($143.7 million).

What Stood Out on Super Bowl Sunday in Illinois

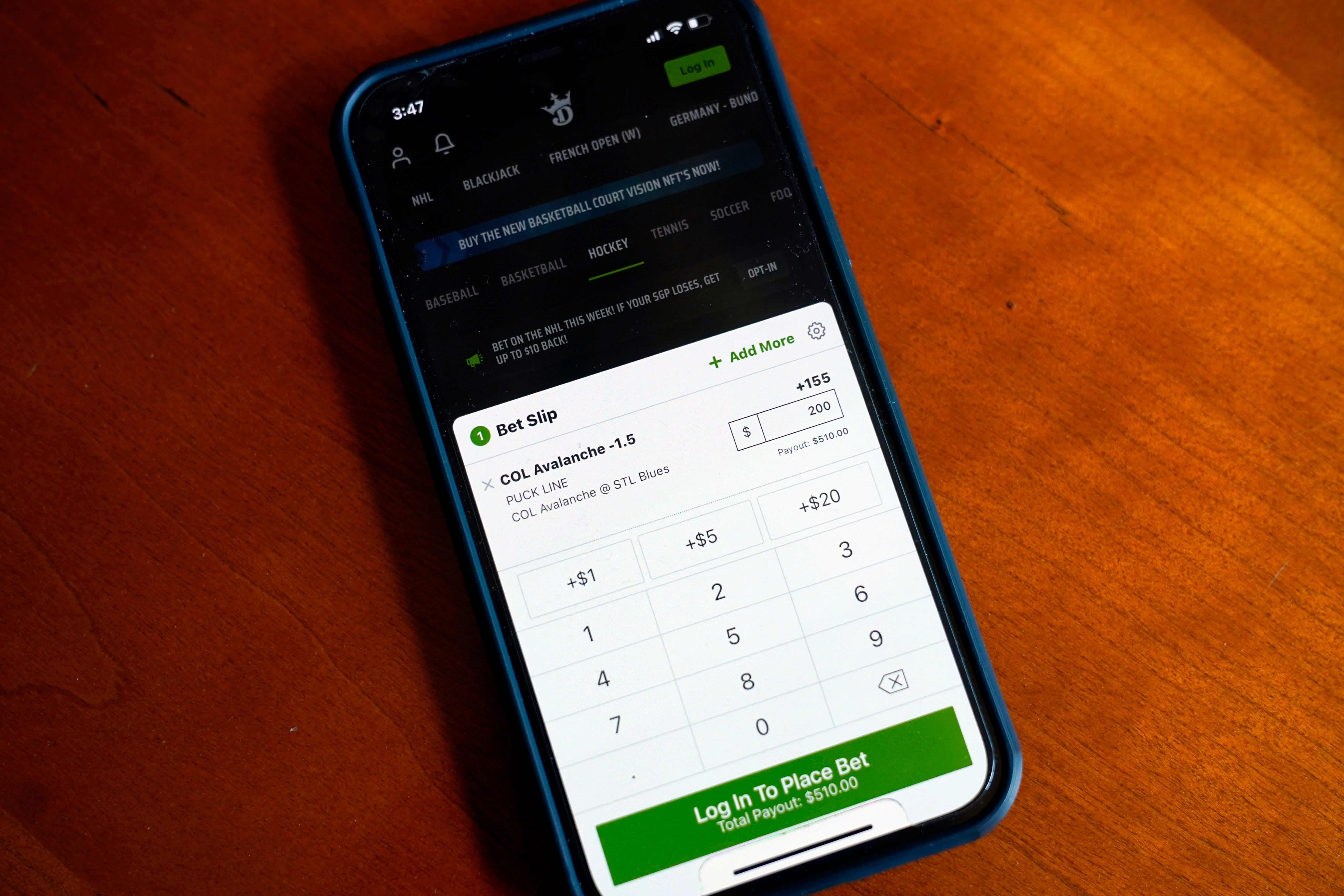

Perhaps the biggest takeaway from the IGB’s Super Bowl report was the performance of DraftKings Sportsbook Illinois and FanDuel Sportsbook Illinois.

The two operators paced the field, with DraftKings bringing in $21.5 million in online and retail handle, while FanDuel Sportsbook brought in $17 million.

FanDuel announced in January plans to build a retail sports betting facility at Chicago’s United Center.

Rivers Casino collected $9.6 million in wagers during Sunday’s game, while Hawthorne Casino and Race Course had $4.9 million in online and retail handle.

Behind those operators were Hollywood Casino Aurora ($4.8 million in online and retail handle), Grand Victoria Casino ($1.8M), Argosy Casino Alton ($483,974 in retail-only handle), and Hollywood Casino Joliet ($272,568 in retail-only handle).

In terms of AGR, FanDuel Sportsbook Illinois led the way with $5 million, followed by DraftKings Sportsbook Illinois ($2.5M), Rivers Casino ($1.05M), Hawthorne Casino and Race Course ($526,640), and Hollywood Casino Aurora ($511,622).

FanDuel Sportsbook Illinois ($750,324) and DraftKings Sportsbook Illinois ($378,130) combined to pay more than $1 million in taxes to the state on Super Bowl wagers.

Big Changes by March in Illinois

Next year’s Super Bowl numbers figure to be even greater due to an upcoming change in Illinois gambling law.

Currently, the state requires bettors to register in person at a retail location before they can use an online betting app. Originally, Illinois would only waive that provision if a mobile-only license was granted. But a law ending the in-person registration requirement by March 5 was signed in late December.

Illinois has yet to issue a mobile sportsbook operator’s license — at a cost of $20 million per license. The cost of online-only licenses prompted major online operators like DraftKings to join forces with casinos or racetracks to enter the market.

BetMGM recently followed suit. It received unanimous approval for a management services provider license by the Illinois Gaming Board in late January. The operator will partner with East Peoria’s Par-A-Dice Hotel & Casino and plans to be live by the time online registration is available March 5.